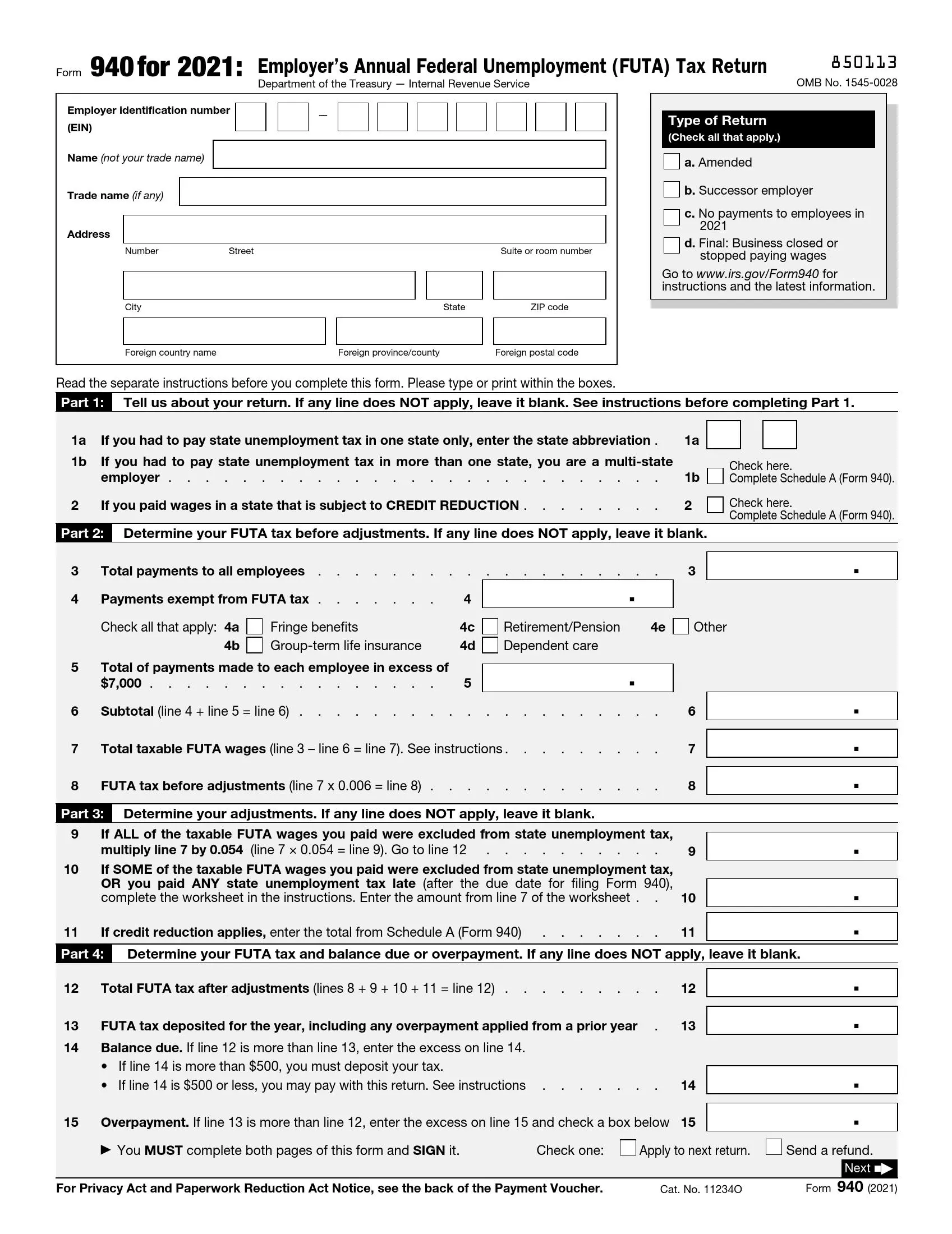

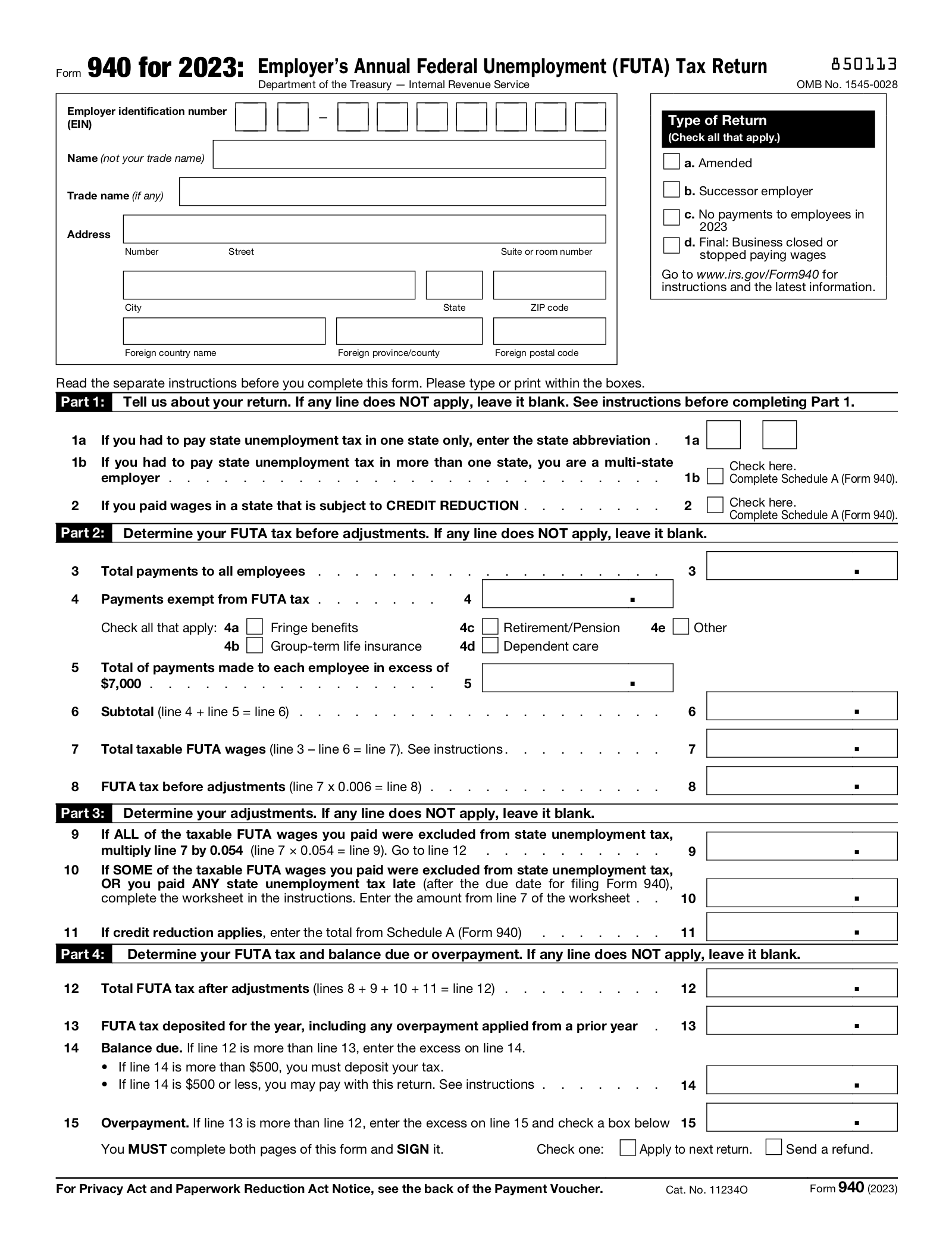

Irs Form 940 Schedule A 2024 – As of 2024, employers and employees throughout the year. The FUTA tax rate is 6% on the first $7,000 in income. After an employee surpasses $7,000 in income, the employer can stop paying FUTA tax . The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2024 tax season is the elimination of the Form 1040EZ. Taxpayers who previously .

Irs Form 940 Schedule A 2024

Source : boomtax.comAnnual IRS Unemployment Tax Forms Confirm FUTA: Fill out & sign

Source : www.dochub.comHow to Fill Out Form 940 | Instructions, Example, & More

Source : www.patriotsoftware.comA Step By Step Guide to Completing Form 940 with TaxBandits | Blog

Source : blog.taxbandits.comIRS Form 940 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comForm 940 and Form 941: Big IRS Updates for 2024

Source : blog.boomtax.comneed help lifting business suspension Google Business Profile

Source : support.google.comForm 940: Employer’s Annual FUTA Tax Return – eForms

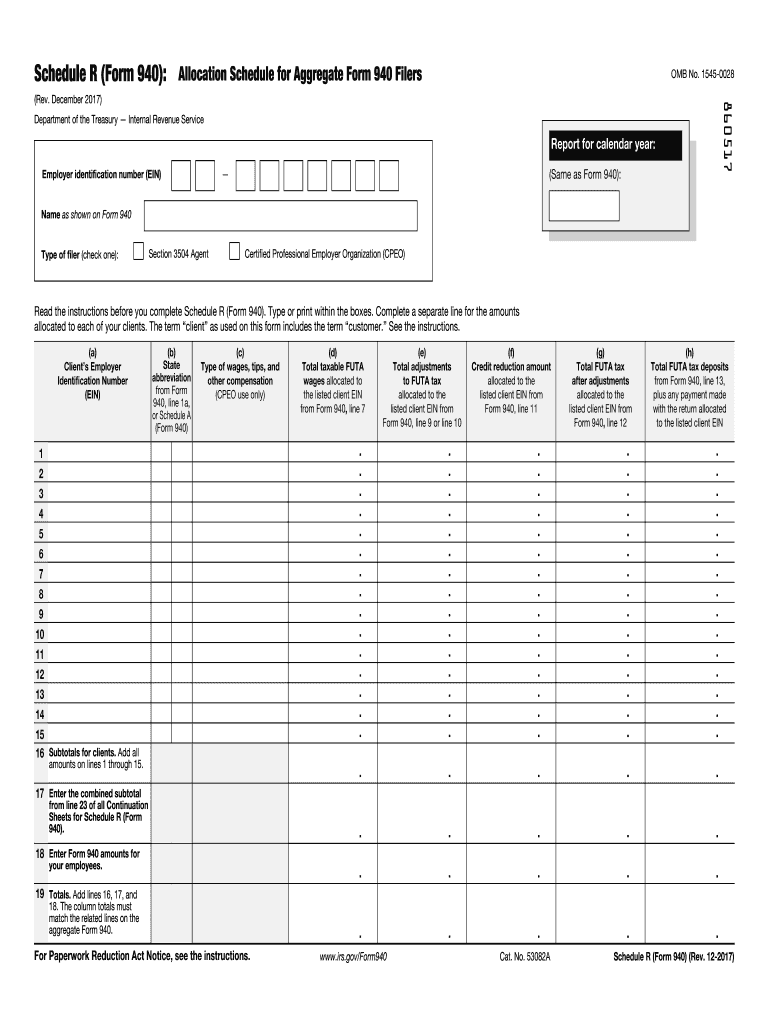

Source : eforms.com2017 2024 Form IRS 940 Schedule R Fill Online, Printable

Source : r-form.pdffiller.comFree IRS Form 940: Employer’s Annual FUTA Tax Return | Download PDF

Source : legaltemplates.netIrs Form 940 Schedule A 2024 2024 IRS Form 940: Annual Federal Unemployment BoomTax: For more tax tips, check out our tax filing cheat sheet and the top tax software for 2024. “There’s no one losses You’re required to file a Schedule C form if you have income from a business. . With the start of tax season, you may be tempted to grab your W-2 form and start filing with your here’s everything you need to know about 2024’s tax season. The biggest reason to create .

]]>